From Chat App to Operational System: WhatsApp’s Role in Emerging Markets Startup Scene

How a messaging app became the backbone of digital business in the Developing World

In much of the world, WhatsApp is still seen as just a messaging app, a place for family chats, forwarded videos, and the occasional voice note from your barber.

But in Latin America, South Asia, and parts of Africa, it has quietly become something much bigger: the default operating system for modern business.

The app that was once just a replacement for SMS is now where business happens. Not through dashboards or SaaS interfaces, but through conversations. Typed, spoken, automated, or AI-enhanced.

For small businesses, WhatsApp is the storefront, the CRM, the marketing channel, and the customer support desk - all in one thread. For e-commerce, it’s the landing page and the checkout. For fintechs, it’s everything from onboarding to account management, peer-to-peer transfers, loan disbursement, and bill payments. For service businesses, it’s where transactions begin and end - quotes, scheduling, follow-up, and retention.

This isn’t a vision of the future. It’s already unfolding, especially across Latin America, where a new generation of founders is building full-stack companies with WhatsApp at the center.

Unlike the Web2 era, this isn’t about building a new platform. It’s about building on top of behavior, and that could be a great opportunity for AI use cases.

How WhatsApp Became the OS of Everyday Business in Latin America

WhatsApp was never supposed to be a business tool. It wasn’t designed for sales funnels, appointment scheduling, or logistics coordination. It was meant to replace texting — lightweight, private, and ad-free.

According to Meta, there are now over 600 million business-related conversations happening every day across its messaging platforms.

With more than 2.5 billion users globally and over 500 million in Latin America, WhatsApp has quietly evolved into something far beyond its original use case. In Brazil, 90% of adults use it daily. In Mexico, more than half of all businesses rely on it to sell, support, and stay top of mind. Across the region, it’s not just a communications layer — it’s where business happens.

This transformation didn’t come from enterprise features or formal SaaS expansion. It came from getting the foundations right:

Low friction: no sign-ups, no passwords, no onboarding.

Cultural fit: People are already used to messaging everyone from their cousin to their lawyer. Businesses were simply the next.

Ubiquity: it works everywhere, on any device, in any bandwidth condition.

Zero discovery effort: you don’t need to install anything. You’re already in the thread.

Compared to branded apps that require behavior change, downloading, registering, and learning, WhatsApp is ambient.

This is why businesses building on top of WhatsApp are not “renting land” in the same fragile way developers once built on Facebook Pages or Twitter’s early API. If anything, WhatsApp is closer to iOS: closed but reliable, tightly controlled but immensely valuable. Founders don’t build around it—they build within it, using conversation itself as the UX.

There’s a deeper point about platform behavior here. Facebook and Twitter once encouraged developer communities to extend their ecosystems. There were bots, dashboards, third-party clients, and niche plugins. But as their core products matured and user growth plateaued, the calculus changed. Every third-party tool became a potential distraction from monetization.

WhatsApp took a different path.

Anatomy of a WhatsApp-Powered Startup

Back in 2016, WhatsApp didn’t offer a public API. Businesses improvised — answering customer messages from personal numbers, forwarding orders by hand, and using unofficial bots that often broke or got blocked. It worked. But even then, something important was happening: behavior. Customers weren’t just willing to interact over chat but preferred it.

If you want to build something on top of WhatsApp today, you need to find someone whom Meta has already trusted and promoted to a Business Service Provider (BSP), like Twilio, 360dialog, Gupshup, Zoko, Vonage. These intermediaries handle business verification, number provisioning, compliance, and billing.

Over time, WhatsApp began rolling out formal APIs, first to large brands via BSPs, and then more broadly. Today, getting API access still isn’t instant, but the process is clearer. Here are the options today, simplified:

You are onboarded via a Business Service Provider (BSP)

You register as a Tech Provider (often called an ISV). This lets you build a product where hundreds or thousands of SMBs can manage their messaging through a shared infrastructure. Think of one API account with many tenants.

You apply to become a Meta Tech Partner. This isn’t required, but it unlocks access to incentive programs, co-branding, and better support. Essentially, Meta starts treating you as an ecosystem infrastructure.

There was never a free tier. From day one, business integration required real volume, verified identities, SLA-backed services, and per-conversation pricing. If you want access, you pay for it. It’s not a playground for hobbyists, like in Telegram.

And that’s part of what makes it durable. When there’s no free playground, there are fewer abandoned experiments.

1/ From low-code builders to infrastructure

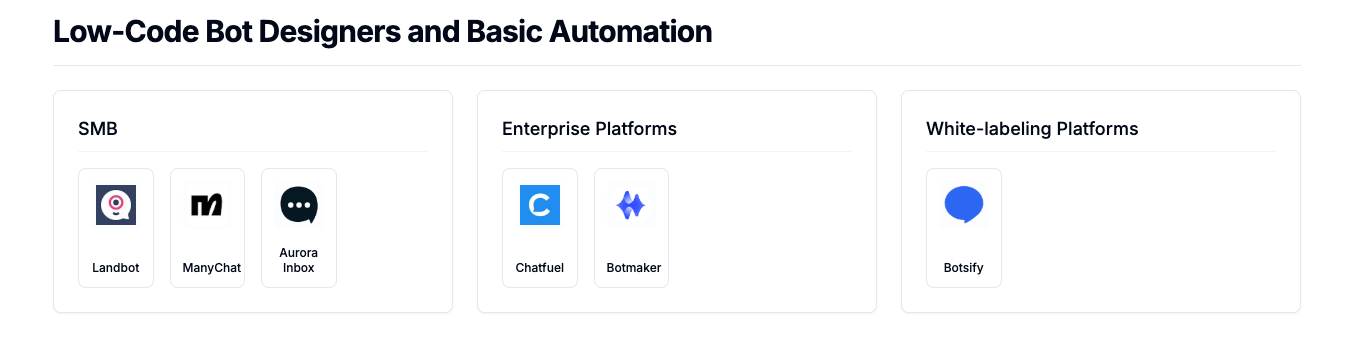

The first serious wave of WhatsApp-native tooling came through low-code platforms like Landbot, ManyChat, Chatfule, and Botmaker. These tools lowered the bar dramatically — suddenly, you didn’t need to know Python or understand Webhooks to build a real conversational flow.

With drag-and-drop interfaces, SMBs could launch support bots, lead capture forms, or even mini checkout flows inside WhatsApp - in minutes. Whether you were a café in Lima, a clinic in Curitiba, or a bike shop in Lahore, these tools worked- if your customers were on WhatsApp, this gave you a way to meet them there.

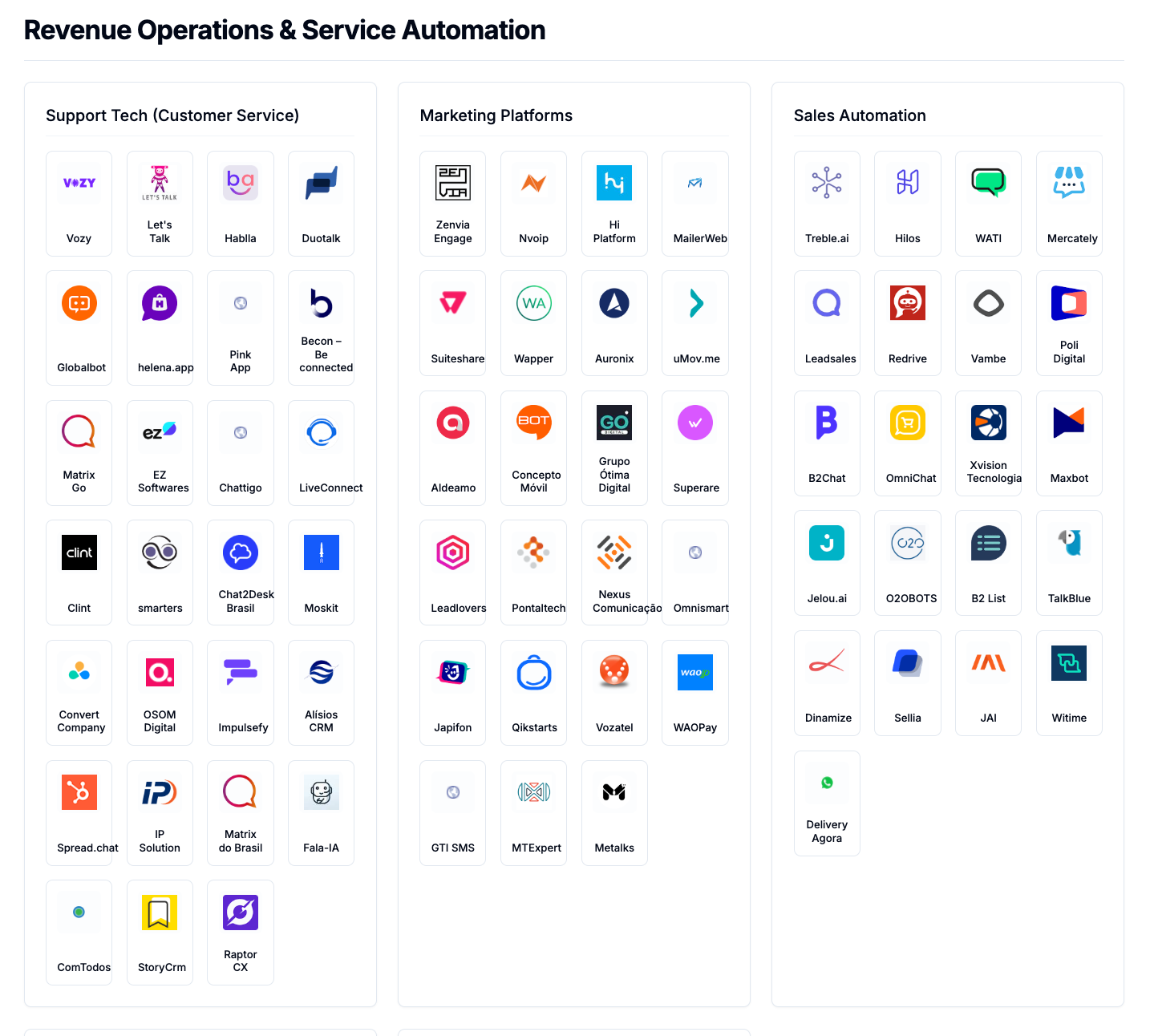

2/ From customer engagement to Vertical SaaS

As things matured, more structured platforms emerged, Customer Engagement Platforms (CEPs). While the low-code platform can implement much of the functionality, case-specific verticalization helped onboard customers seeking turn-key solutions. Tools like Treble, Revi, Avify, and Omnichat combine messaging with deeper layers: CRMs, inventory, campaign tracking, and payments. They’re WhatsApp-native dashboards for running a business.

And gradually, Meta introduced WhatsApp Business first as a separate app, then with catalogs, messaging templates, and basic automation.

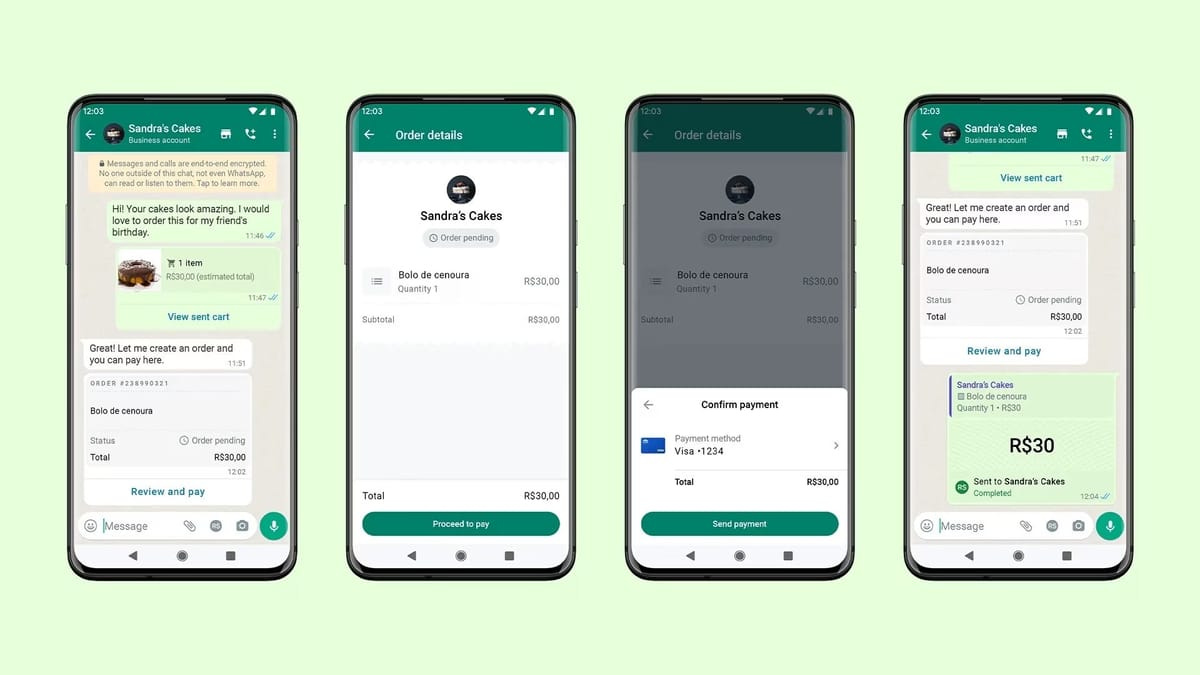

The catalog feature, in particular, was transformative. It turned WhatsApp from a support channel into a storefront, enabling, for the first time, something that looked like real e-commerce inside chat. Meta is building deeper tooling - from verified business accounts to built-in catalogs, automated replies, and payments.

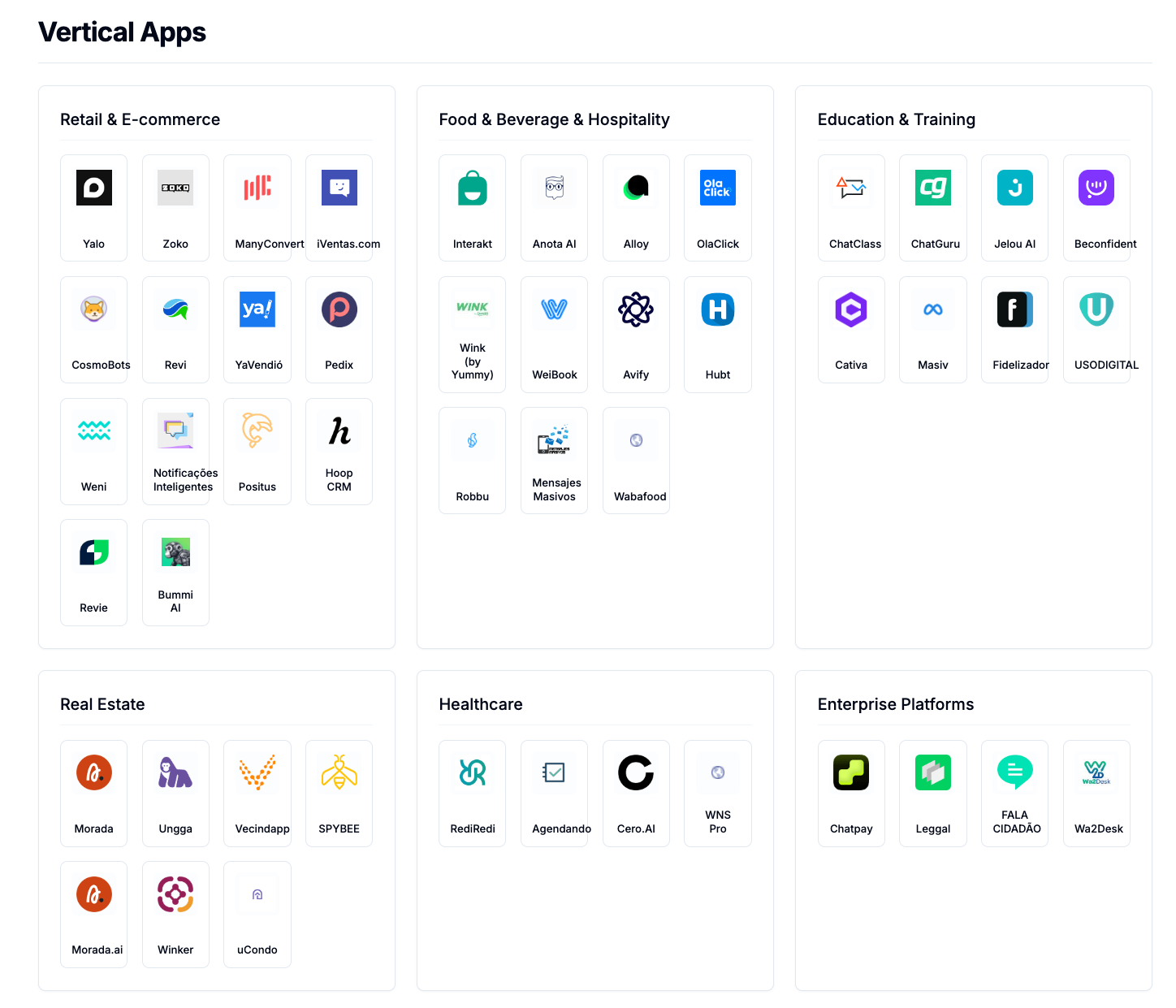

But the most interesting frontier is verticalization.

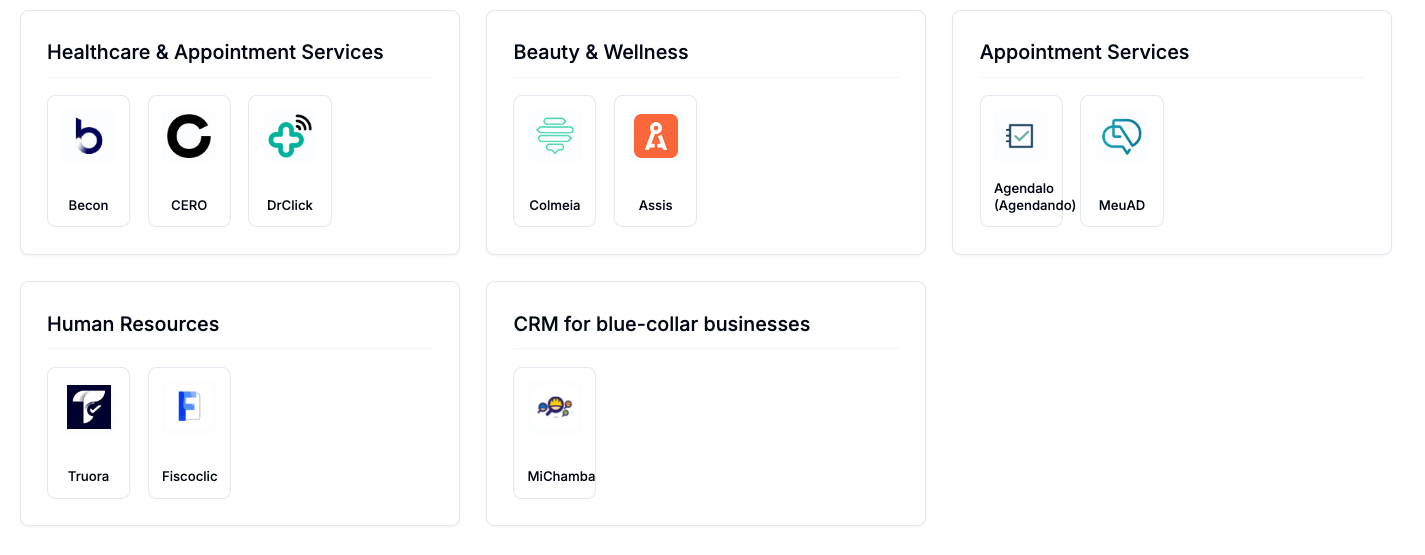

DrClick helps clinics manage scheduling and patient communication.

Morada turns WhatsApp into a real estate operating system.

Assis is building tools for Brazil’s 25 million solopreneurs, including tools for creating quotes, managing follow-ups, and collecting payments—all via chat.

OlaClick uses WhatsApp’s native catalog as part of its food commerce flow.

Avify integrates WhatsApp templates into inventory and logistics.

Mercately wraps payments, CRM, and chat into one flow using the official API.

MiChamba is creating a task manager for the blue-collar sector, all managed through WhatsApp.

These tools look and feel like CEPs, but they’re built around very specific workflows and regulations. They don’t just organize conversations but embed operational logic.

What’s Changed in 2025?

The real unlock wasn’t in WhatsApp itself — it was the LLM layer.

It's perfect for dealing with unstructured data, understanding intent, automating decisions, and executing external functions directly from the chat. Suddenly, WhatsApp became a full-stack execution layer. And that changed the kind of products being built.

1. From messaging to orchestration

The first wave of WhatsApp tools focused on surface-level automation. You could answer FAQs, capture leads, and maybe confirm an order, but the workflows were shallow, disconnected, and mostly manual behind the scenes.

But now we're seeing tools that treat chat as the entry point to a broader, integrated value chain.

The verticalization trend has naturally developed into building end-to-end systems around sector-specific problems.

A pharmacy in Mexico can now trigger stock updates from its ERP, process in-chat payments, and send delivery updates, all within the same thread. Or a real estate team in Brazil can connect incoming leads to property listings, run credit scoring through a third-party API, schedule showings, and send contracts — without leaving WhatsApp.

Many companies (like OlaClick or Alloy) are WhatsApp-first, not WhatsApp-only. They rely on WhatsApp for reach, but they also integrate across web, mobile, and POS systems. WhatsApp is the front-end, but not the full stack.

2. AI Agents (Not just chatbots)

The opportunity isn’t just to support automation, it's a full AI employee.

Think about a task that’s:

Repetitive

High-volume

Time-sensitive

Data-rich, but rarely analyzed

That's the lead qualification. That’s onboarding. That’s product recommendations. That’s 80% of what happens in WhatsApp business threads today. The leap from chatbot to agent is subtle but meaningful. It’s the difference between “here’s a link” and “I’ve just placed your order.”

The chat thread becomes the UI, but the business logic lives behind it. Inventory, payments, contracts, logistics — the pieces that make the message matter.

Nowadays, most of the products that have already established strong relationships in the vertical and customer engagement space are leveraging AI.

3. Conversational Fintech finally gets good

WhatsApp has long been used informally for financial coordination: sending transfer receipts, confirming payments, and checking balances. In many markets, these behaviors became normalized before formal in-app payment integrations ever existed.

What’s changed in 2024–2025 is that fintech products have caught up with the behavior.

Companies like Félix Pago, Magie, and Luka now offer full financial workflows entirely within WhatsApp. These include remittances, bill payments, recurring transfers, and even credit scoring - all handled via structured chat interfaces.

Félix handles U.S.-to-LatAm remittances using USDC, with no need for an app or web portal.

Luka enables recurring utility payments through a conversational interface.

OnePay processes over 15 million transactions monthly in Colombia, directly through WhatsApp.

In Brazil, the adoption of PIX, the national instant payment network, accelerated WhatsApp’s use in financial services. Since receiving regulatory approval, WhatsApp Pay, Meta’s payment service in Brazil, has rapidly gained traction. Today, telecom operator Claro processes more than 500,000 customer bill payments each month through WhatsApp Pay via Pix. The merging of messaging and payments removed a major point of friction. Messaging wasn’t just a channel; it became a standard interface for confirming and completing transactions.

The second shift is interaction quality. LLMs now enable these financial flows to operate through natural language, without rigid input structures. Users don’t navigate menus — they write or speak their intent. The assistant handles the interpretation, follow-up, and execution.

This reduces the user's cognitive load and expands addressable use cases. Financial products no longer require UI literacy or formal onboarding. The same assistant who answers a balance question can also schedule a transfer or qualify a lead.

4. Finally, a super-app in WhatsApp?

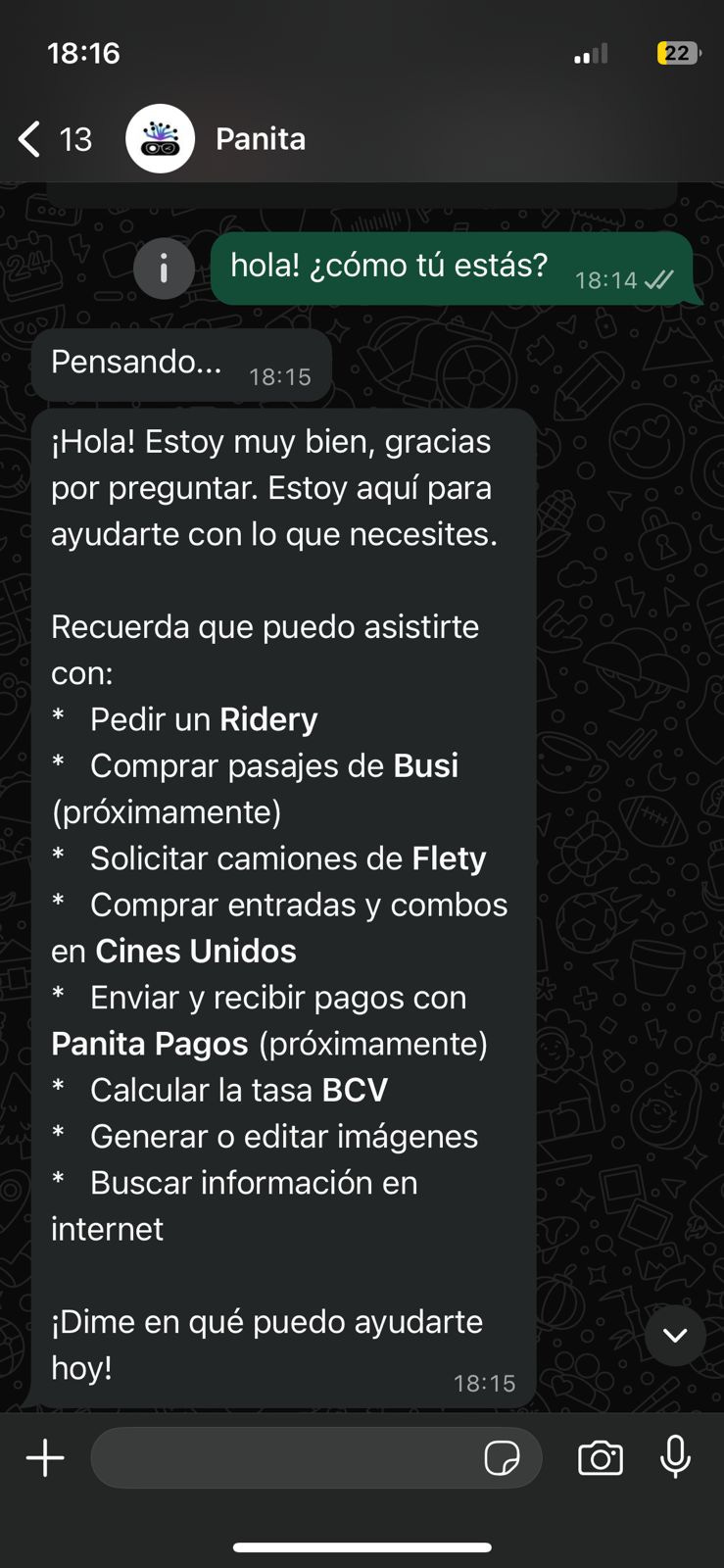

We may be seeing early versions of that. In Venezuela, Paninta is becoming the “ChatGPT of WhatsApp” - integrating ride-hailing, banks, and ticketing into one assistant.

Through Panita, a user can order Ridery (local ride-hailing app) rides, buy bus tickets, request Flety trucks, purchase tickets to cinema and combos, send and receive payments with Panita Pagos (coming soon), calculate the BCV exchange rate, generate or edit images, and search the internet.

This works in countries with low smartphone adoption and limited internet access. The logic is that one assistant is better than five apps.

Why is it Working in LatAm but not in other Emerging Markets yet?

WhatsApp-based startups are thriving in Latin America, a phenomenon distinct from other regions with high WhatsApp usage.

While WhatsApp is popular in countries like India, Indonesia, Pakistan, and Vietnam, the specific market dynamics that foster these startups are unique to Latin America.

Commerce dynamics vary markedly across markets: say, in Uzbekistan, merchants rely heavily on Telegram to establish and maintain customer relationships; in Kazakhstan, Instagram has emerged as the predominant buying and selling platform; in Pakistan, a handful of local WhatsApp–based startups have sprung up, but Facebook continues to dominate overall commerce activity; and in Egypt, aslo Facebook remains the primary hub for transactions, with WhatsApp used chiefly for follow-up communications—where large B2B providers often overshadow smaller, specialist ventures.

Despite this regional disparity, we believe there is potential for growth in South Asia and the Middle East. Founders in these regions can draw inspiration from the successful models in Latin America and adapt certain products to meet their local needs and market conditions.

If you’re building in that space, let’s chat!

Photo credit:

ALFREDO ESTRELLA/AFP/Getty Images

A bit disappointing that you opted for AI-generated text. It is way fuzzier and more difficult to read wrt your earlier articles.

For the rest, thanks for sharing your thoughts on WA, would have never thought that their closed business model could be that successful